Part-1: Understanding Product Category

by Erik Mintz with contributions from Lisa Crow

My first in-depth experience with product categories started in 2008 while working for Constant Contact (CTCT). CTCT went public in October 2007 on the success of their Email Marketing product. Their second product called “Online Survey,” also released in 2007 was built in-house. For their third product, CTCT decided to take the acquisition route. Through research, they discovered high customer demand to assist small businesses to plan, manage and track their events online. This need led to the acquisition of my Event Management company in May 2008 – Constant Contact’s first acquisition!

Determining your product category label is essential to how you position your product and how consumers perceive your solution

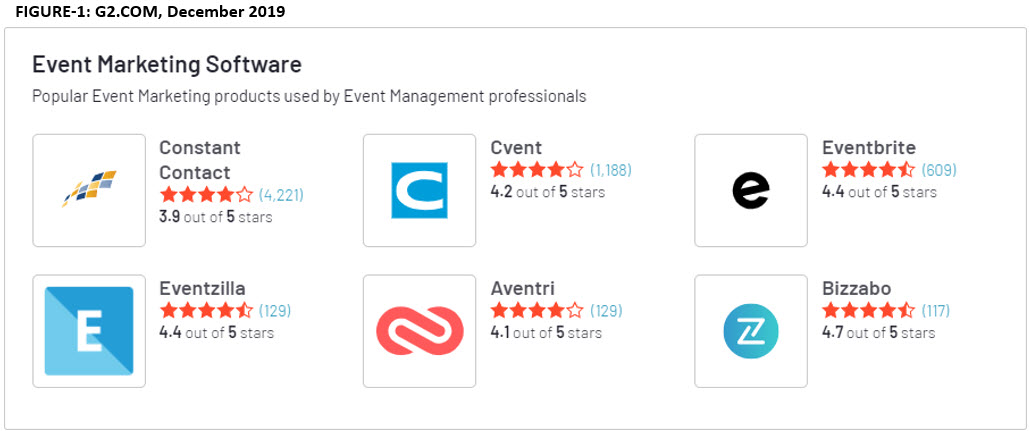

In collaborating with the Product Marketing team, one of the first strategic initiatives we embarked on was to determine the product category label. Based on a series of customer forums, we narrowed down the list to three leading contenders: “Event Management,” “Online Registration” and “Event Marketing.” I had been lobbying for “Event Management,” but based on customer feedback, we settled on “Event Marketing” because there was parity with “Email Marketing.” Figure-1 is a snapshot of the Event Marketing category from G2.COM.

Category confusion can lead to rejection from loyal customers

CTCT’s main objective with the Event Marketing product was to cross-sell to existing Email Marketing customers who were managing events manually, mainly using spreadsheets. One of the unintended consequences of choosing the category label Event Marketing, was that it confused existing Email Marketing customers who thought it was just another fancy email campaign. They were not buying it. In effect, we created “category confusion” for existing Email Marketing customers. The two labels were not distinct enough from each other. While other factors can contribute to this confusion (e.g. messaging, industry life cycle, etc.), it had mostly to do with the label. This example demonstrates that a company’s category labeling strategy can have performance implications on the business.

The story did have a happy ending. While we were doing a poor job of cross-selling into the base, we far exceeded the forecast of attracting new customers with their first purchase being Event Marketing. And, even better, these same customers in-turn purchased Email Marketing. While the net result was positive, this experience underscored the importance of a category labeling strategy!

Elements of the product category include a category label and product design

I initially set out to write an article on Product-Market Fit (PMF), but I quickly realized that I couldn’t tell this story without providing the foundation of a “product category.” As you will come to learn, the elements of a product category include the category label and product design, or just “design” for short. The design element of a category plays a pivotal role in achieving PMF, as described in Part 2. It took me a few years to connect these dots, but there is an implicit relationship between category and PMF.

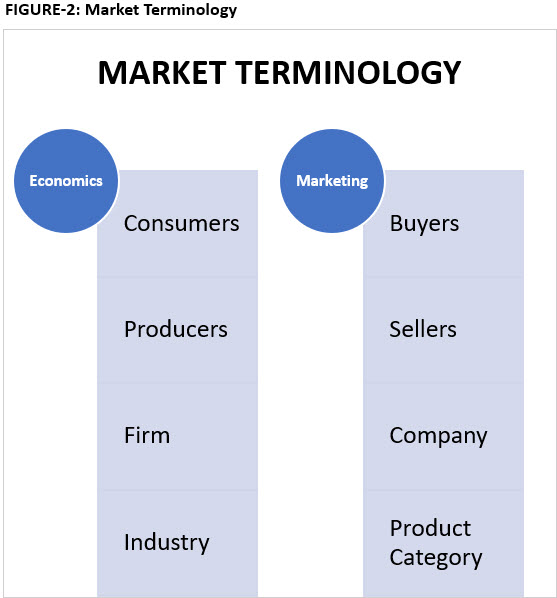

To begin, when we refer to a Market from an economic perspective, we use terms like “consumers,” “producers,” “firm” and “industry.” In modern marketing terms, we replace these words with “buyers,” “sellers,” “company” and “product category,” or just “category,” for short. Being that I identify with the MarTech world, it is more fitting to use the Marketing vernacular. See Figure-2: Market Terminology.

Understanding the behavior of categories from inception through maturity provides a strategic advantage to outperform your competitors

There was a multiyear academic research project undertaken on the Smartphone industry to understand better the dynamics through which new product category labels emerge. This research was published in 2013 and titled; “Perfect timing? Dominant category, dominant design, and the window of opportunity for firm entry.” Now while your eyes might glaze over at the title of this paper, I am here to tell you that this is the most profound research into understanding how categories emerge! Every entrepreneur, company and investor entering into a nascent market should read and understand this research. For startups and companies entering into a new or early market, understanding the behavior of categories from inception through maturity will provide a strategic advantage to outperform your competitors. For investors providing startups with capital, understanding the category should be your very first question. The research also dispenses the notion that first-movers have all the advantage!

Overview of Research

I commonly refer to this academic research as “Category Dynamics.” I have been using these concepts since 2015, to assist early-stage and mature companies to navigate nascent markets. Many of the concepts have proven to be true, insightful or instructive in several scenarios. Below is a brief overview of Category Dynamics necessary to better understand Product-Market Fit (PMF), as described in Part 2. This academic research provides much more in-depth knowledge into how categories evolve, market-entry timing and labeling strategies than what I discuss in this article.

In a Mature Market, there is a dominant category label and design

A label is a word or combination of words used to “refer to products that address similar needs and compete for the same customers.”² In a mature market, the research calls this the “dominant category label.”² It conveys to the buyer what the product does, who uses it and who is the competition. Buyers expect a product in the same category to have a basic common design, meaning there are “rules of membership”² for the product. In a mature market, the research calls this the “dominant design.”² Examples of mature categories include Email Marketing, CRM and Smartphone. Try buying a smartphone without GPS navigation and social media. These are all expected features for a Smartphone. If not included, the seller would pay the penalty.

In a Nascent Market, there is no dominant category label and design

In a new or early market, there is no dominant category label. The meaning of the label is fuzzy, and it’s unclear how the product would be used causing a potential buyer to take a “wait and see”² attitude towards a purchase. There is no dominant design. The buyers have no expectations of a common design because it does not exist. There are no “rules of membership” for the product, as of yet.

Conclusion

The two essential elements of a category are the label and design. The label itself can have performance implications to your business as described in the CTCT scenario. A labeling strategy is far more than just picking a word or groups of words. As I work with early-stage or mature companies entering into a nascent market, I try NOT to ever create a label without thorough research into the market. While the research does provide guidelines for a labeling strategy, I always perform a search to see if any labels exist. In an early market with competitors, I look to see how other companies are referring to themselves. The goal is to land on the dominant category label, whether or not you create it.

As a way to speed up the adoption process for a new category label, I suggested to a startup I was mentoring in a new market with two competitors to get all three companies together, and agree on the category label. Think of this as “category collusion.” In a Nascent market, the labels are “still relatively shallow in meaning,”² so this would eliminate the confusion for the buyers, thus allowing the sellers to concentrate on the design. Let the best product win!

In a mature market, “a dominant category label reduces the uncertainty and confusion surrounding the meaning of a new type of product, making it clearer to buyers and sellers what the new product is for and how it should be used.”² A dominant design will fulfill the expectations for the buyer in terms of a common feature-set. New companies entering the market should adopt the category label and design; else they will pay the penalty.

In a new or early market, there is a “proliferation of labels that attempt to describe the new product category which creates confusion for the buyers.”² A dominant category label and design does not yet exist. There are no “rules for membership” established regarding the product.

The notion of a common design in a mature market or, lack thereof, in a nascent market, is an important concept to understand in order to achieve PMF. It was this clue that helped me understand the implicit relationship between category and PMF.

Click this link for Part-2

It is time to rethink Product-Market Fit!

REFERENCES

1. Fernando F. Suarez | Stine Grodal | Aleksios Gotsopoulos, Perfect timing? Dominant category, dominant design, and the window of opportunity for firm entry, Wiley Online Library, 26 December 2013

2. Fernando F. Suarez | Stine Grodal, Mastering the ‘Name Your Product Category’ Game, MITSloan Management Review, Winter 2015