Ultimate Guide to Prioritizing Enterprise Deals

A how-to guide to identifying deals worth pursuing or when to say no to further investing in them.

Ring that gong! Imagine a year when sellers meet quota every quarter and your company surpasses sales forecast. Not so fast. According to CSO Insights, 60% of forecasted deals never close.

The reality is that most of your B2B leads likely will not convert to sales. Timing may not be right, you may lose to the competition, or your solution is not a good fit for solving their immediate needs. You may wonder if your team is chasing the right deals? There has to be a better way to identify winnable deals upfront.

This guide reveals our proven data-driven framework based on decades of evidence-based selling pathology for Deal Health Assessment for prioritizing Enterprise deals. We share the four essential criteria every Enterprise sales organization should measure to improve the odds of sellers chasing viable deals and not wasting their time and energy on zombie deals – deals you don’t know are dead.

High-performing sales teams are 1.5 times more likely to base forecasts on data-driven insights. Unfortunately, only 46% of sales reps have data insights on customers’ propensity to buy, despite 85%of those who do, saying it makes them more effective in their job.

– Salesforce, 3rd Annual State of Sales

A Systematic, Data-Driven Approach to Deal Pursuit Boosts Win Rates

Often, sellers have not identified the complete buying team and therefore get the wrong signals from the wrong buying influencers about the likelihood of a legitimate opportunity. Sellers give high confidence that the deal will close, but then it does not. CRM Sales Stage, Close Date and sellers subjective input have proven not to be reliable for assessing deal health and propensity to buy.

When forecasts are missed quarter to quarter and management is rigid on sales targets, bad habits form within an organization. The unintentional directive from leadership causes sellers to pad the pipeline and move opportunities from quarter to quarter. Bloated pipelines cause sellers to expel energy in the wrong places. Sales leadership and operations have a challenging time determining which deals to prioritize. Without an objective, data-driven buyer-centric approach to prioritizing opportunities, sellers waste their energy on deals that may never close.

Just 28% of closed deals are forecasted accurately. Close amounts

are off by 31% from the forecasts. The bigger the deal, the more

likely sales reps are to overestimate the outcome.– InsideSales.com Labs

Replace Subjectivity with Data Science

Enterprise sales leaders require transparency to understand opportunity status and propensity to buy for strategic, high-value deals. Often Deal Reviews are scheduled to communicate status. Within a large-sized sales organization, Deal Reviews for each opportunity is not a scalable solution. Deal Reviews require intense preparation from sellers, reducing their time spent pursuing deals. Management does not have the time to meet with every seller about every high-value deal. Management must allocate sales resources appropriately to maximize sales and meet the forecast. How do leaders

prioritize which deals their team pursue without a scientific approach to Deal Health assessment?

Changing the behavior and measurement criteria for assessing Deal Health and prioritizing opportunities is critical to prioritize deals effectively.

Enterprise sales need a simple, repeatable data-driven process that everyone can and will embrace. Base assessment on data science, not gut-feel, and encourage consistent deal coaching and deal health assessment framework.

Prioritize Deals Based on Buyer Insight, Not Sales Stage or Close Date

In a typical firm with 100-500 employees, an average of 7 people are involved in most buying decisions (Gartner Group.) To assess deals, you must understand the organization’s objectives, identify the buying team and evaluate each buying influencer’s role, goal, and intention.

Has the seller identified and mapped the critical relationships needed to win the deal? Mapping buyer relationships is the first step in determining the viability of an opportunity.

It is critical to identify the Decision-Maker – who has final authority and Decision Influencers affected by the decision.

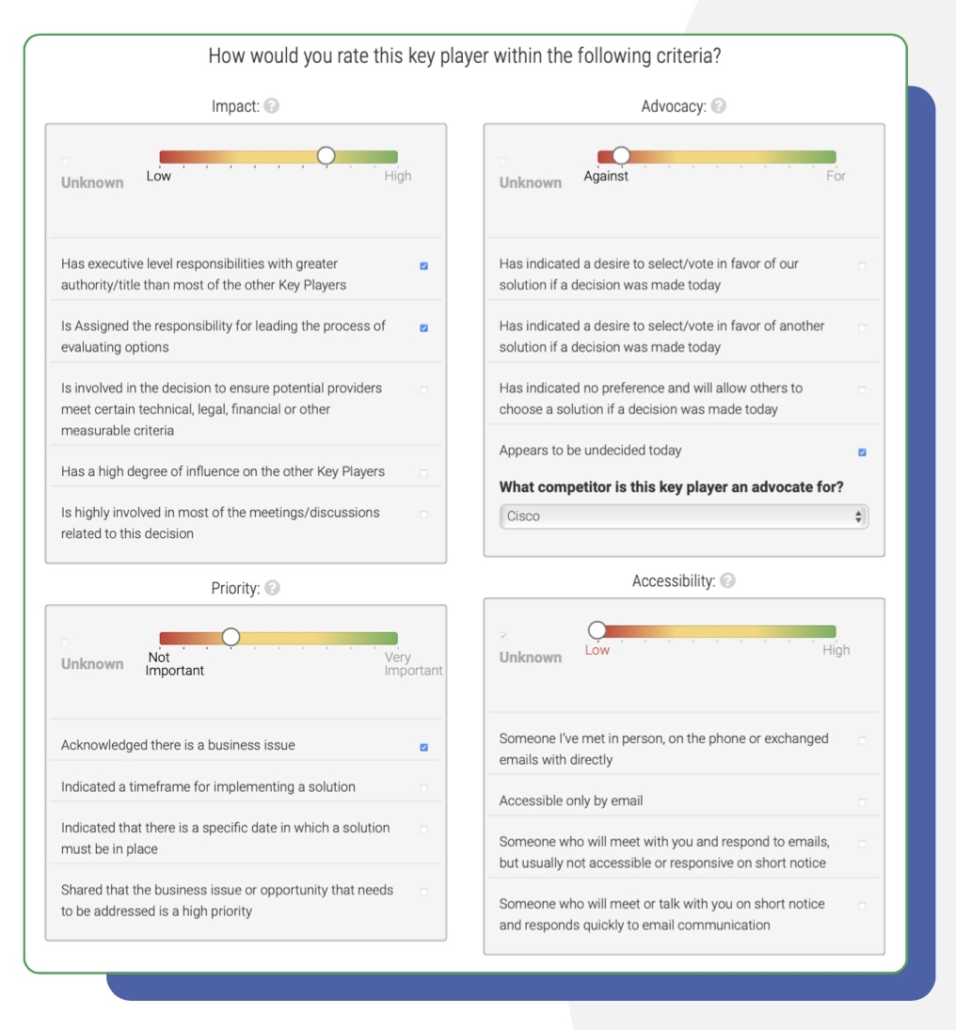

Four critical factors are most relevant to strategic deals that should be the basis for prioritizing Enterprise sales opportunities. Once you have identified the Buying Team, measure each Key Player (Decision-Maker or Decision Influencer) on the following four critical criteria:

Deal Health

A buyer-centric deal health assessment framework is a more accurate way to prioritize Enterprise deals. Impact and Priority help Enterprise teams assess Deal Legitimacy to determine if a deal is worth pursuing. Advocacy and Accessibility help assess Deal Position to determine sellers’ stance with the Buying Team, and which relationships need work.

DealCoachPro turns qualitative inputs into data science for easy, fast, objective measurement. A custom, deal health scoring system can help set consistent criteria in determining which deals to prioritize and invest in and which not to. A thorough assessment seems daunting and more involved than simply looking at Sales Stage, Close Dates or relying on subjective input, but your confidence level increases significantly. And more importantly, you can ensure Enterprise sellers are focused on converting opportunities into high-value customers.

Fuel your Enterprise sales pipeline with a systematic, data-driven approach to Deal Health assessment. Know with a greater degree of confidence which deals are worth pursuing and when to say no to further investing in them with DealCoachPro.

Bio

Lisa helps high-growth SaaS companies communicate their story, launch innovative products and services, and accelerate revenue. For over two decades, Lisa has held leadership roles in product marketing and Marcom at Constant Contact, LogMeIn, Continuum, and Aha! Lisa earned a B.S. in Business Administration from Northeastern University.